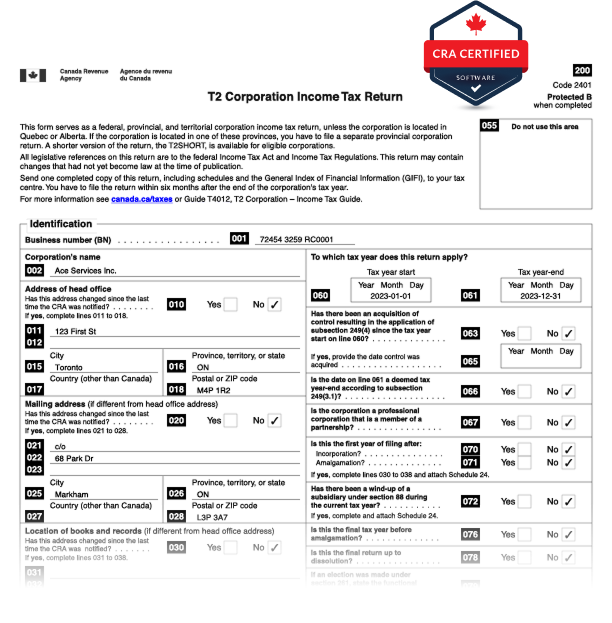

CRA certified

Built by Tax Experts

Corporate Tax Focused

Canadian business owners filing with Gofile

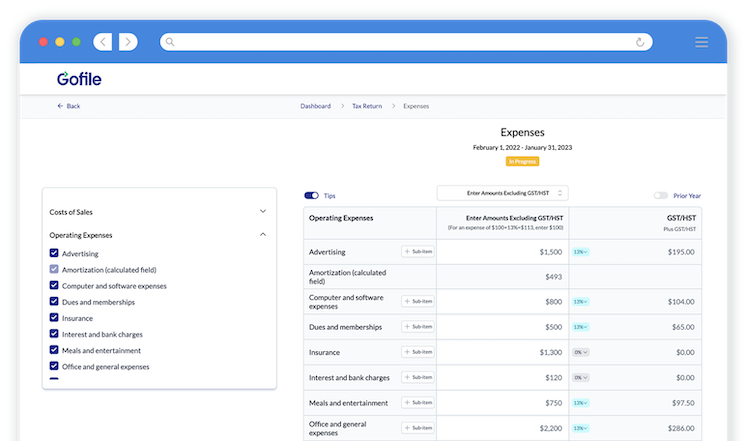

Entering your business numbers is fast & easy.

- Simplified categories make it easy to enter your income, expenses and balances.

- We'll map everything to the tax return for you. No headaches trying to figure out complicated forms.

- With done-for-you calculations and step-by-step guidance, you can take back control and confidently DIY your corporate taxes.

Helpful support, there when you need it.

- Claim every deduction while staying compliant - Get help from our Canadian tax experts who help you identify eligible deductions while keeping you compliant.

- Support designed for business owners - Our team provides tax help in plain English, without the jargon that can make tax filing confusing and intimidating.

- Timely responses when you need them most - Receive prompt assistance when deadlines are looming and you need to keep moving forward without delays.

Why Gofile?

Most corporate tax software is designed for accountants.

Gofile is built specifically for business owners who want to prepare their own corporate tax return with confidence - without needing accounting expertise.

We handle the calculations, structure, and validation required for a CRA-ready return, while keeping the process clear and guided from start to finish.

Gofile vs accountant-focused T2 software | ||

|---|---|---|

| Accountant-focused software | ||

| Designed for non-accountants | ||

| Guided data entry | ||

| Automatic tax calculations | ||

| Plain-language explanations | ||

| End-to-end self preparation | ||